If you aren’t sure whether the refund was sent or not, and it’s been more than four months since you filed your tax return, reach out to us for help: www.philalegal.

If they see that the check was never deposited, or that it may have been stolen, they can send you a replacement. The IRS will look at what happened to the money they sent.

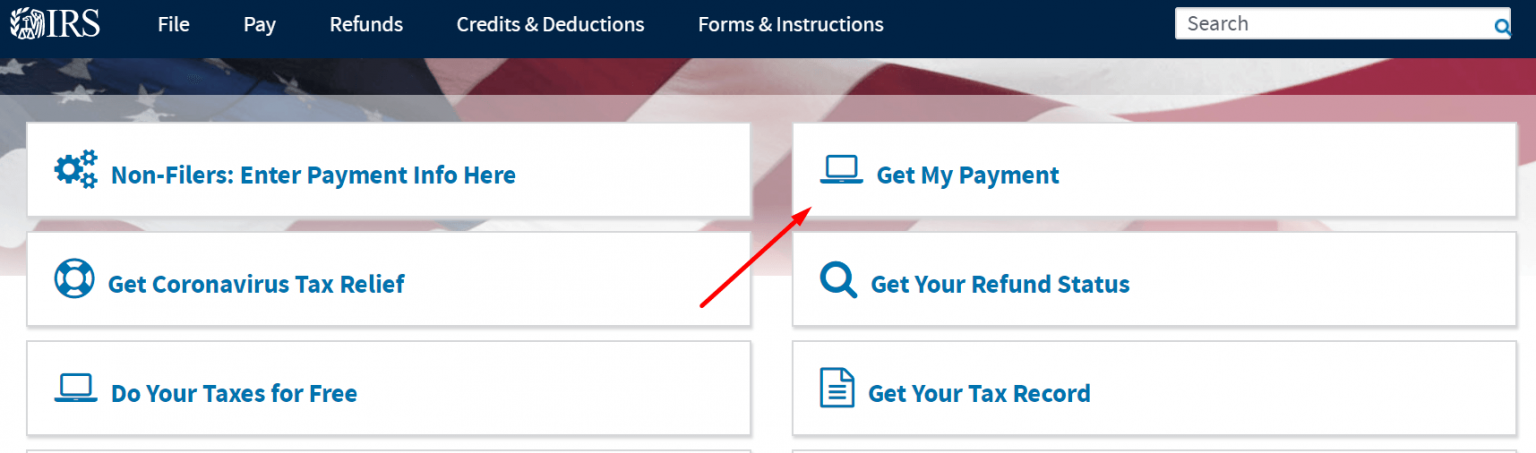

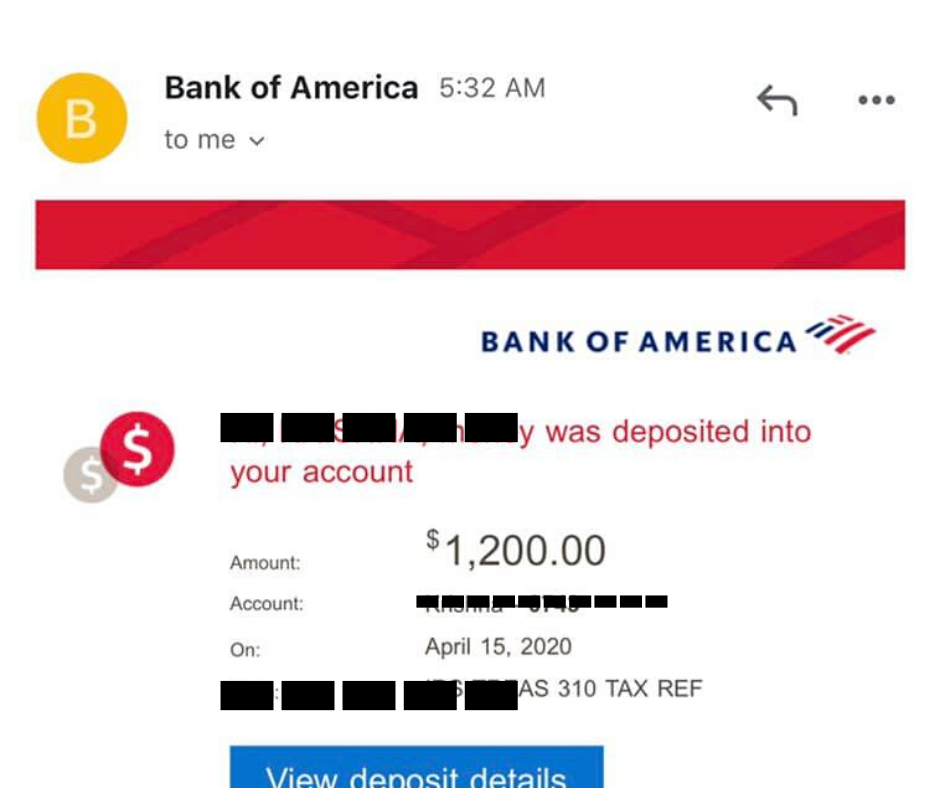

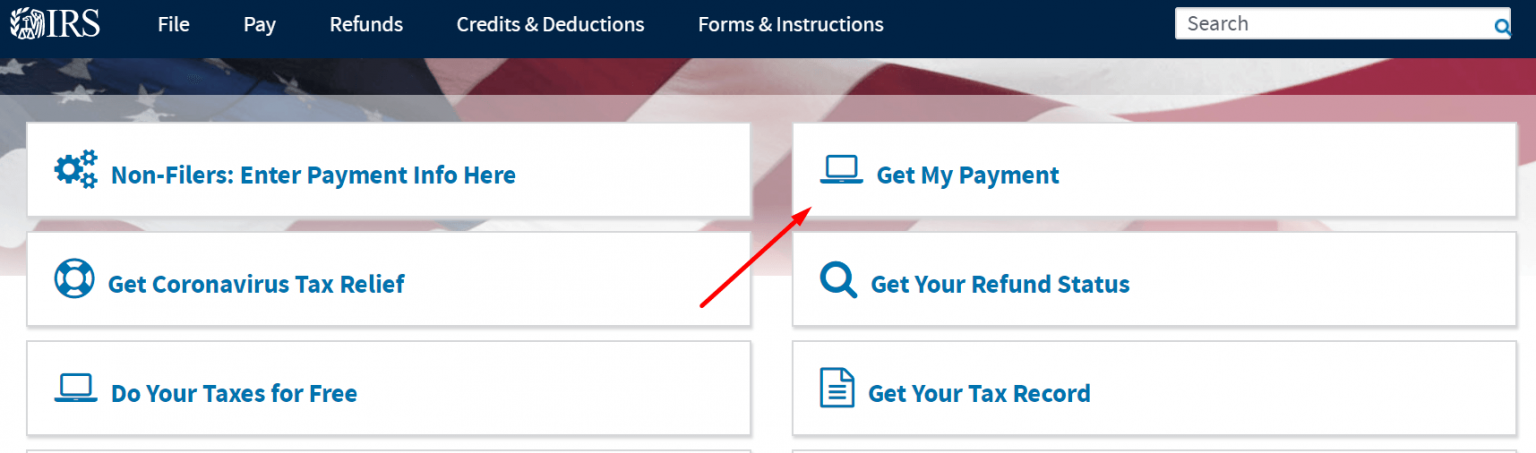

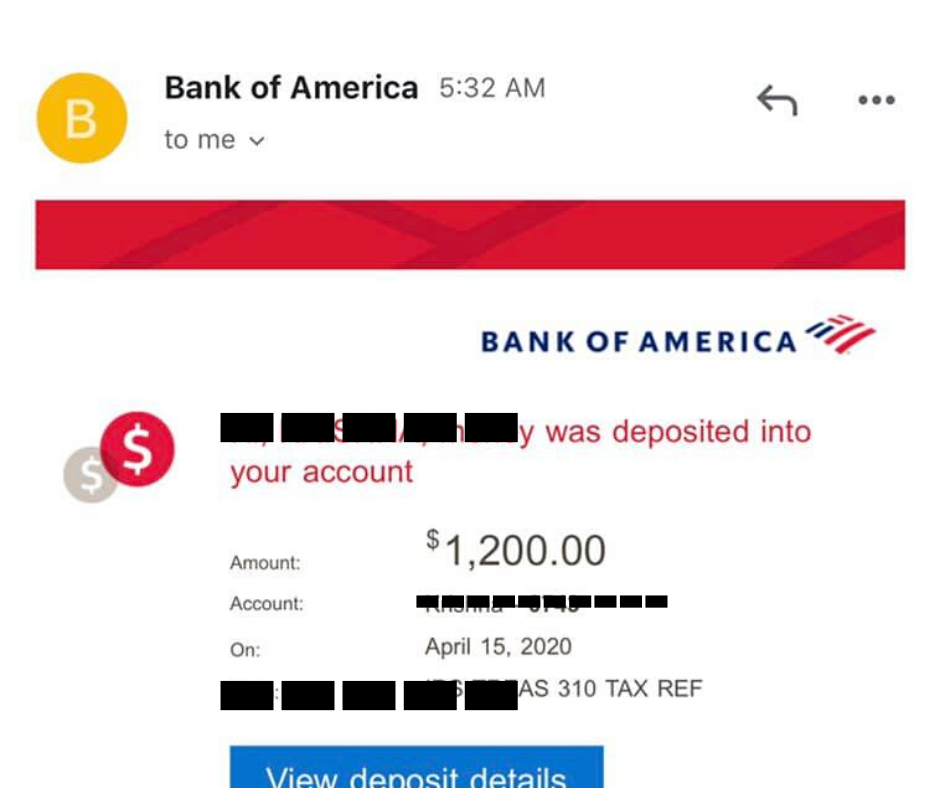

If the IRS sent your refund or stimulus payment, but you never received it, use Form 3911 to request a “refund trace": Fill out Section I and Section II, then sign and date in Section III. Another option is to set up an account on the IRS website and use it to view your 2020 “account transcript” and see whether the IRS sent you the first two stimulus payments, whether your tax return was processed, and whether your refund was sent: You can check on the status of the third stimulus payment here: . Go to and enter your information to make sure the refund was actually sent. It could be that the IRS is still processing your return and hasn’t yet issued the payment. If you’ve been waiting a long time for a refund, it doesn’t necessarily mean the check was lost. Check status of stimulus check how to#

Here’s how to request a replacement from the IRS if you missed a payment you were expecting. The case may then become a civil matter between you and the financial institution and/or the owner of the account into which the funds were deposited.If you’ve had problems with your mail, or you moved without updating your address, you may have missed stimulus checks or tax refunds from the IRS. If funds are not available or the bank refuses to return the funds, we cannot compel the bank to do so.Even if you did not request a direct deposit, these types of refunds are directly deposited into the preparer’s financial institution, so you should contact the preparer for resolution. Usually this occurs when you authorize the fee for preparation to be taken from your refund.

You requested a Refund Anticipation Loan (RAL) or Refund Anticipation Check (RAC) through your preparer or preparation software.We will issue a paper check for the amount of that deposit once it is received. Ways to check your status Check your refund online (does not require a login) Sign up for Georgia Tax Center (GTC) account. There are two options for checking on the status of your stimulus check and which one you use depends on whether or not you are required to file Federal income taxes.

You incorrectly enter an account or routing number and the number passes the validation check, but the designated financial institution rejects and returns the deposit to us. The IRS Stimulus Check Portal is an online tool you can use to check on the status of your stimulus check, enter your direct deposit information, and confirm your mailing address. In this case, we will send you a paper check for the refund instead of a direct deposit. You omit a digit in the account or routing number of an account and the number does not pass our validation check. The following are some common issues with direct deposits and how they are handled: Once the funds are returned, we will issue a paper check to the address indicated on your return. In general, if you have an issue with your direct deposit, such as closing your bank account after you submitted your return, the financial institution will return the funds to us. We are not responsible for a lost refund if you entered the wrong account information for a direct deposit.

You incorrectly enter an account or routing number and the number passes the validation check, but the designated financial institution rejects and returns the deposit to us. The IRS Stimulus Check Portal is an online tool you can use to check on the status of your stimulus check, enter your direct deposit information, and confirm your mailing address. In this case, we will send you a paper check for the refund instead of a direct deposit. You omit a digit in the account or routing number of an account and the number does not pass our validation check. The following are some common issues with direct deposits and how they are handled: Once the funds are returned, we will issue a paper check to the address indicated on your return. In general, if you have an issue with your direct deposit, such as closing your bank account after you submitted your return, the financial institution will return the funds to us. We are not responsible for a lost refund if you entered the wrong account information for a direct deposit.

0 kommentar(er)

0 kommentar(er)